科技股看roe还是roa

Title: Evaluating Technology Stocks Using the PricetoEarnings Ratio

Introduction:

The pricetoearnings (P/E) ratio is a commonly used financial metric to evaluate the investment potential of stocks. In the context of the technology sector, analyzing the P/E ratio can provide insights into the company's earnings performance, growth prospects, and relative valuation within the industry. This article will guide you on how to assess technology stocks using the P/E ratio and offer suggestions on its limitations.

Understanding the P/E Ratio:

The P/E ratio is calculated by dividing the stock's market price per share by its earnings per share (EPS). It indicates how much investors are willing to pay for each dollar of earnings generated by the company. A higher P/E ratio suggests that investors have higher expectations for future growth, while a lower ratio may indicate undervaluation or lower growth expectations.

Interpreting P/E Ratios for Technology Stocks:

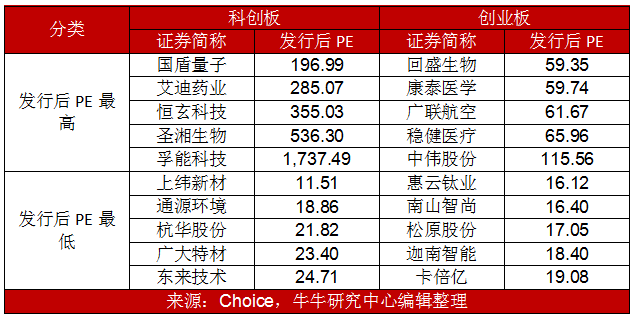

1. Comparison with Industry Peers: It is important to compare a technology company's P/E ratio with its peers in the industry. A significantly higher or lower P/E ratio relative to the sector average can provide insights into the company's competitive position, growth potential, and market sentiment towards the sector as a whole.

2. Historical and Projected Earnings Growth: Consider the company's historical earnings growth rate and its projected growth. If a company consistently demonstrates strong earnings growth or has promising growth prospects, a higher P/E ratio may be justifiable. Conversely, a lower P/E ratio may be expected if the company is experiencing stagnant or declining earnings.

3. Volatility and Risk: Technology stocks can be more volatile than stocks in other sectors due to rapid technological advancements, changing consumer preferences, and market uncertainties. Assess the company's risk profile and adjust your evaluation accordingly. A higher P/E ratio may be justified for a tech company with a solid track record and a stable growth trajectory, while a lower P/E ratio may indicate higher risk or uncertainty.

4. Consider the Company's Stage of Development: Technology companies can be categorized as either mature or growthoriented. Mature companies with stable cash flows and established market positions typically have lower P/E ratios. Growthoriented companies, on the other hand, may have higher P/E ratios due to higher growth expectations but also higher risks.

Limitations of the P/E Ratio:

1. Lack of Industry Context: The P/E ratio alone may not provide a complete picture of a technology stock's valuation. It is essential to consider other factors such as revenue growth, market share, competitive advantages, and industry dynamics.

2. Earnings Manipulation: Some companies may manipulate their earnings to inflate the P/E ratio, making the stock appear more attractive. Be cautious and look for signs of sustainable earnings growth and transparent accounting practices.

3. Limited Comparability: When comparing P/E ratios across technology companies, it is crucial to consider the differences in business models, growth rates, and risk profiles. A thorough analysis should also consider the company's financial health, management team, and competitive advantages.

Conclusion:

Analyzing the P/E ratio is a useful tool for evaluating technology stocks but should not be the sole determinant for investment decisions. It is important to consider a range of financial ratios, industry dynamics, and companyspecific factors to make informed investment choices. Remember, the P/E ratio is just one piece of the puzzle, and a comprehensive analysis is required for a holistic assessment of a technology stock's investment potential.